Youth Finance

Time Is The Essence Of Money Posted on Oct 30th 2015

Time value of money, or the ‘power of compounding’ as I like to call it, works best when we are in our teens because of the abundant amount of time that we have!

In definition, time value of money is: “The value of money at a future point in time might be calculated by accounting for interest earned or inflation accrued”.

But to put it simply it means that your dollar would be worth more or less, in a sense due to inflation or a potential investment generating interest.

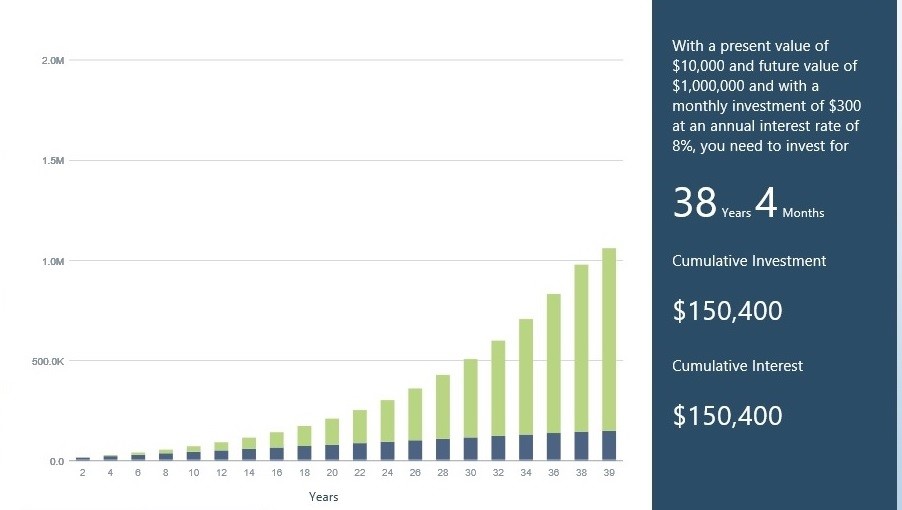

So, to showcase this, I’ve used one of the finance tools available to illustrate the time value of money, as well as a graph for viewing pleasure! So right now, you are Investor A.

Suave and knowledgeable, and being able to generate a constant 8% on your returns. You don’t go round drinking martinis everyday so you manage to scrimp about $300 a month to put in your investment portfolio, with a starting investment of about $10000.

Studying The Market

Assuming the market doesn’t fluctuate (which it would) in 38 years’ time you would half a total investment portfolio worth about a million dollars!!!

It might seem like a long time to obtain a million dollars but however looking back at the graph, you can see that your cumulative investments, or what you physically put in, is only $150,000.

Compounding is reaping in the rewards for you, without even putting in any extra effort. So all that time not downing shots actually paid off!

Of course you might say “Bullshit! That isn’t realistic! Where am I going to get 8% return on my investments?!” To that I shall say “Bro example only”. Of course a constant 8% isn’t going to be easy to get. Not factoring things like inflation, brokerage fee, etc.

But hopefully this is going to get you started on your investment journey. We have much potential to grow our money, we’d only have to reach out and seize it!